Here’s what thousands of consumers are quickly learning about paying off their debt:

When people visit CuraDebt,1 they may be surprised to learn that many have managed to clear their debts in just 24-48 months* with CuraDebt's specialized program. What's more impressive is that you could resolve your debt for less than what you owe today. With millions of Americans still grappling with piling debt, it's high time people explore and take advantage of this service.

A Choice Many Don't Think Of

The first choice many consumers think of is to take out a debt consolidation loan. For those with good credit, this is an attractive option but there’s a catch:

Lenders are only happy to give out loans to people who are creditworthy and can show the ability to make the loan payments. Unfortunately, people with poor or fair credit often do not qualify for this option.

This is bad news for the millions who are faced with high interest and unpayable debt. Their debt only continues to accumulate. Fortunately, there is a solution. This debt relief option is available to all qualified individuals regardless of credit. With help from the right debt relief company, you could design a program you can actually afford.

Who Should I Work With?

CuraDebt is one of the most reputable companies in the industry with over 19 years of proven experience. To date, CuraDebt has helped nearly 200,000 people resolve their debts! They've helped thousands of ordinary Americans regain control of their finances.

To find out if you qualify, simply answer a few questions about your debt and financial circumstances. It only takes a few minutes to get a free, no-obligation quote online. You'll also have the opportunity to speak with a certified debt consultant to review your specific situation and learn more about your options. Stop overpaying on your debt and find out how you can finally tackle it for good.

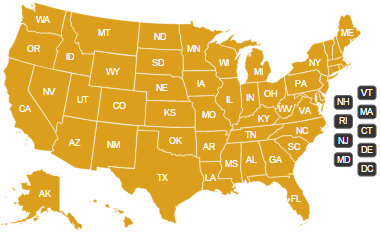

Select Your State: